Share this

6 Ways Leasing Equipment Helps Your Business

by Alicia Cannon on Mar 12, 2018

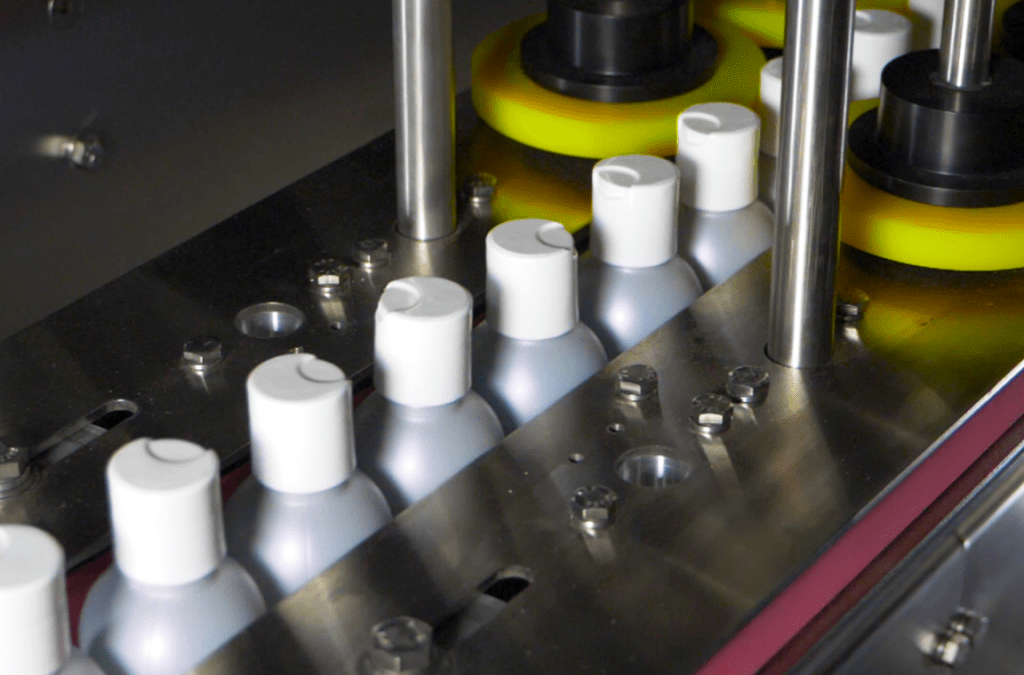

Whether it is a manual filling machine for a home-based cosmetics company, or an automatic machine for a major distillery filling thousands of bottles a day, specialized equipment can be one of your more expensive business purchases. Fortunately, leasing is a way for business owners to get use of equipment without tying up capital or risking obsolescence.

Advantages to leasing your business equipment.

Reduced Upfront Costs

Reduced Upfront Costs

Purchasing all of the equipment you need at once can drain the liquid assets of your business, leaving it vulnerable to sudden, unforeseen expenses that may arise later. In fact, running out of cash too quickly is one of the most common reasons startups fail. Leasing equipment is a great way to divide the cost of equipment into manageable, predictable payments made every month, leaving more cash available for emergencies.

In addition, lease terms and monthly payments can be adjusted to meet the needs of almost any budget. This helps you acquire equipment without much capital expenditure.

Credit Lines Available for Other Uses

Some businesses wish to open a line of credit with a bank to make equipment purchases, but a new business can have trouble meeting the minimum requirements to qualify. (Many banks require a company to be in business for six months and have at least $25,000 in annual revenue.) Even if you qualify, choosing to lease your equipment instead can leave those credit lines free for other uses.

Tax Advantages

One of the major tax advantages to leasing is that it accelerates depreciation. Instead of drawing out depreciation over five to ten years, as the IRS requires for a cash purchase of industrial equipment, leasing allows you to treat your monthly payments as rentals. This allows you to depreciate your equipment over the lease term instead, which may last five years or less.

The other advantage is that leasing can help you avoid the Alternative Minimum Tax (AMT). Depreciation expenses are sometimes included for calculating the AMT, as the tax was developed to penalize excessive tax sheltering. Leasing, however, is considered “off balance sheet financing”. This kind of expense is not included on balance sheets, and therefore is not subject to the AMT. Avoiding this tax can save your business thousands of dollars each year.

The other advantage is that leasing can help you avoid the Alternative Minimum Tax (AMT). Depreciation expenses are sometimes included for calculating the AMT, as the tax was developed to penalize excessive tax sheltering. Leasing, however, is considered “off balance sheet financing”. This kind of expense is not included on balance sheets, and therefore is not subject to the AMT. Avoiding this tax can save your business thousands of dollars each year.

Protection Against Obsolescence

If you are not entirely certain that your machinery will be what you need several years from now, leasing your equipment may be the better option. If a disruptive technology changes the landscape of your industry, or if a new improvement to the equipment you use makes your old machinery unprofitable by comparison, leasing gives you the freedom to upgrade your equipment at the end of – or even during – your lease term. Before accepting a leasing arrangement, make sure the lender allows upgrades or add-ons to the lease. They should accommodate these requests with only an add-on in billing and no penalty.

Room for Growth

Even without changes to your industry, your business may grow beyond your initial projections. A small food manufacturer may find that they need to switch from semi-automatic to automatic filling systems to meet demand. If they lease their machinery, they can get use of their new equipment without raising the money needed for a large deposit.

Flexible Terms

Flexible Terms

Leasing arrangements are usually more willing than banks to accommodate the individual needs of a small business. One of Apex’s preferred lenders Max Sarango, with Providence Capital, offers custom financing and payment plans for businesses that want to lease equipment. Max Sarango, has an expertise in offering customized financing for over 15 Years and can assist with your equipment purchase needs. Being “Fast, Efficient, and effective” is priority #1 when it comes to all transactions offered.

Leasing lenders are often more responsive than banks. Mr. Sarango says “Our programs are streamlined to save you time and effort. There are no lengthy forms to fill out, and credit decisions are usually made within 24 to 48 hours”. His firm also bases leasing payments on fixed rates as a protection against inflation.

Apex can help design a customized plan to meet your business financing needs. To learn more, call us at (219) 575-7493 or visit our financing page to learn more. To contact Max Sarango about leasing arrangements, call him at (714) 985-6201 or write to him at msarango@providencecapitalfunding.com.

Alicia Cannon

Integrity, honesty, and a dedication to delivering ambitious results serve as the central themes of Alicia’s career and are evident in every interaction she has with our clients. Her relationship-centered leadership style has paved the way for Apex Filling System’s culture of compassion & empathy, executed with accountability that ensures consistently great outcomes. As a learner for life, her pursuit of continuous personal and professional growth has led Apex Filling Systems to be recognized as an industry innovator in customer experience. Holding advanced degrees in the areas of engineering and management, she has a unique ability to analyze processes, identify potential problems before they arise, and develop standardized solutions to ensure every client of Apex Filling Systems enjoys a hassle-free, professional, and pleasant experience. Her leadership style has been influenced by the work of some of the most well-regarded thought leaders throughout the last 50 years. Among them are Jim Collins, Sally Hogshead, John Maxwell, and Tony Robbins.

Share this

- Help First (82)

- Apex Filling Systems (54)

- Filling Equipment (52)

- Informational (48)

- Automatic Filling Machine (41)

- Industry Insights (39)

- Packaging Equipment (32)

- About Apex (20)

- Fillers (15)

- Automatic Capping (11)

- Apex Filling (10)

- Apex (7)

- American Made Goods (6)

- Uncategorized (5)

- Apex Team (3)

- Apex Family (2)

- Absolute Truth (1)

- Apex Way (1)

- Petroleum (1)

- oil (1)

- March 2026 (1)

- February 2026 (1)

- December 2025 (4)

- November 2025 (4)

- October 2025 (5)

- September 2025 (3)

- June 2025 (3)

- May 2025 (6)

- April 2025 (10)

- March 2025 (10)

- February 2025 (12)

- January 2025 (14)

- December 2024 (1)

- November 2024 (4)

- October 2024 (4)

- September 2024 (2)

- August 2024 (1)

- July 2024 (4)

- October 2022 (1)

- September 2022 (1)

- June 2022 (1)

- October 2021 (2)

- June 2021 (1)

- May 2021 (1)

- April 2021 (2)

- March 2021 (2)

- February 2021 (1)

- January 2021 (2)

- November 2020 (1)

- October 2020 (1)

- September 2020 (2)

- August 2020 (1)

- July 2020 (1)

- June 2020 (1)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (2)

- January 2020 (3)

- December 2019 (2)

- November 2019 (6)

- October 2019 (4)

- September 2019 (3)

- August 2019 (6)

- July 2019 (2)

- April 2019 (1)

- February 2019 (1)

- January 2019 (7)

- December 2018 (6)

- November 2018 (5)

- October 2018 (2)

- September 2018 (2)

- August 2018 (1)

- July 2018 (3)

- May 2018 (2)

- April 2018 (1)

- March 2018 (2)

- February 2018 (2)

- January 2018 (2)